‘It is clear that the U.S. tariff initiative is only its opening gambit’

| Photo Credit: Getty Images/iStockphoto

President Donald Trump’s announcement of reciprocal tariffs has come as a shock, though it is not a surprise. The new tariffs consist of two parts: the existing commodity-wise import tariff and an additional reciprocal country-wise common tariff for all goods. The resultant tariffs are country-wise as well as commodity-wise. The reciprocal tariffs announced are now on hold and limited to 10% for 90 days, except for China.

Calculation of reciprocal tariffs

The calculation of the reciprocal country-wise tariff is based on the following formula:

U.S. discounted tariff rate = (-1) * (1/2) * exports from U.S. – imports to U.S.)/imports to U.S.

The parametric assumptions are such that no individual tariff or import demand elasticities appear in this formula. The formula in substance is not the way to determine the tariff rate. In addition, the table presented by Mr. Trump has a column ‘charged to the US’. This is misleading. This is not the tariff rate imposed by various countries. It is simply double the discounted reciprocal tariff rate. India’s reciprocal tariff is worked out below using magnitudes of exports and imports in billion dollars for 2024.

India’s discounted reciprocal tariff rate = (-1) * (1/2) * (41.8 – 87.4)/87.4 = 26.1% = 26%

This penal tariff rate is to be added to the tariff that is presently applicable for various commodities. The 26% rate would be a common additional element for all commodities. For countries that are not listed in the reciprocal tariff list, a floor rate of 10% has been announced. This will be added to their individual commodity-wise tariff rates.

Some commodities have been presently exempted from the levy of the additional discounted reciprocal tariff. These include steel/aluminium articles, autos/auto parts, copper, pharmaceuticals, semiconductors, lumber articles, bullion and energy and certain other minerals that are not available in the U.S.

Calibrating India’s response

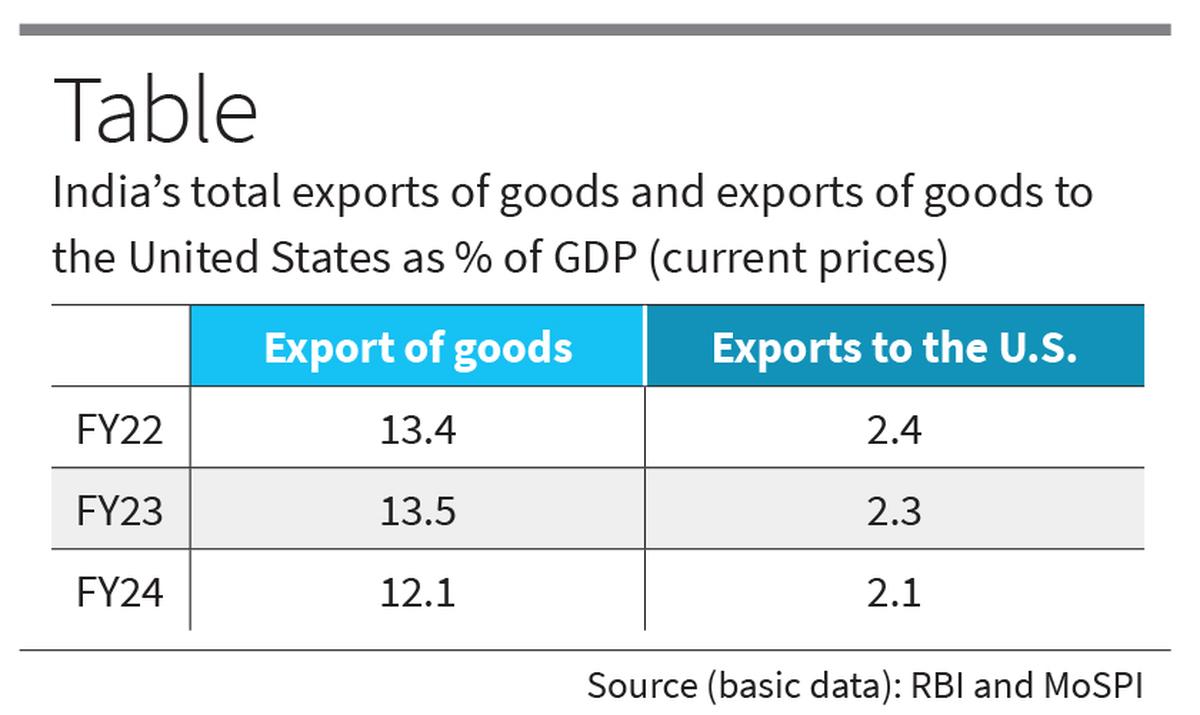

We need to explore now what our reactions should be. As indicated in the Table, India’s total exports of goods and its exports to the U.S. as a percentage of GDP are moderate.

India’s exports to the U.S. are not only quite low but have also been falling in recent years. The impact of the additional 26% tariff would be small but different for different exported goods. India is certainly not a country that is heavily dependent on exports.

An analysis of major exports to the U.S. in terms of their share in total exports to the U.S. indicates that the main Indian exports that would be affected by the imposition of the additional 26% tariff would be electrical machinery, gems and jewellery, machinery and mechanical appliances, mineral fuels and articles of iron and steel. Pharmaceuticals are not yet subject to the additional tariff. Mineral fuels are refined oil products that are re-exported to the U.S. after processing in India. The impact on gems and jewellery is likely to be minimal as its demand is relatively inelastic. The main items that would therefore be affected include electrical machinery, machinery and mechanical appliances and made-up textiles. However, India’s competitors in these three commodity groups such as China, Vietnam, Cambodia and Bangladesh have also been subjected to reciprocal tariffs which are higher than that of India. South Korea is also a competitor in electronic goods but has been subjected to a 25% reciprocal tariff, which is very close to that of India.

Some countries such as China have started levying reciprocal tariffs. However, this has elicited an aggressive response from the U.S., resulting in a revised overall tariff rate for China at 145%, which has been raised up to 245% for certain commodities. From India’s angle this is not a good approach.

India’s approach must be multi-pronged. An analysis of the major imports of India from the U.S. indicates that most of these are ‘essentials’. Any levy of additional tariffs on them will make them more expensive. If India increases its imports from the U.S. wherever possible and advantageous, the penal reciprocal tariff rate on India will come down. For example, in the formula described above, if we increase the magnitude of India’s imports from the U.S. by $25 billion, say, by substituting the import of petroleum from other sources to the U.S., India’s reciprocal tariff rate will come down to 11.8%, just above the floor rate of 10%, making India far more competitive. This does not affect India’s overall current account deficit. This results only in a change in the composition of India’s oil imports basket. This may be even desirable.

India should speed up consultations with the U.S. trade authorities to work out a comprehensive trade arrangement taking into account the concerns of both countries. In the meanwhile, we should also watch out for ‘dumping’ in India by other countries such as China which are seriously affected.

WTO must take the lead

It is clear that the U.S. tariff initiative is only its opening gambit. Global trade and tariff structures would remain subject to considerable uncertainties in the near to medium term, which are bad for world trade and growth. As we move forward, we need to create a world trading system marked by low tariffs. The World Trade Organization should move strongly in this direction. Regional groupings are only a ‘second best’ solution which, however, must be pursued.

C. Rangarajan is Former Chairman, Economic Advisory Council to the Prime Minister and Former Governor, Reserve Bank of India. D.K. Srivastava is Honorary Professor, Madras School of Economics, and Member, Advisory Council to the Sixteenth Finance Commission. The views expressed are personal

Published – April 17, 2025 12:08 am IST