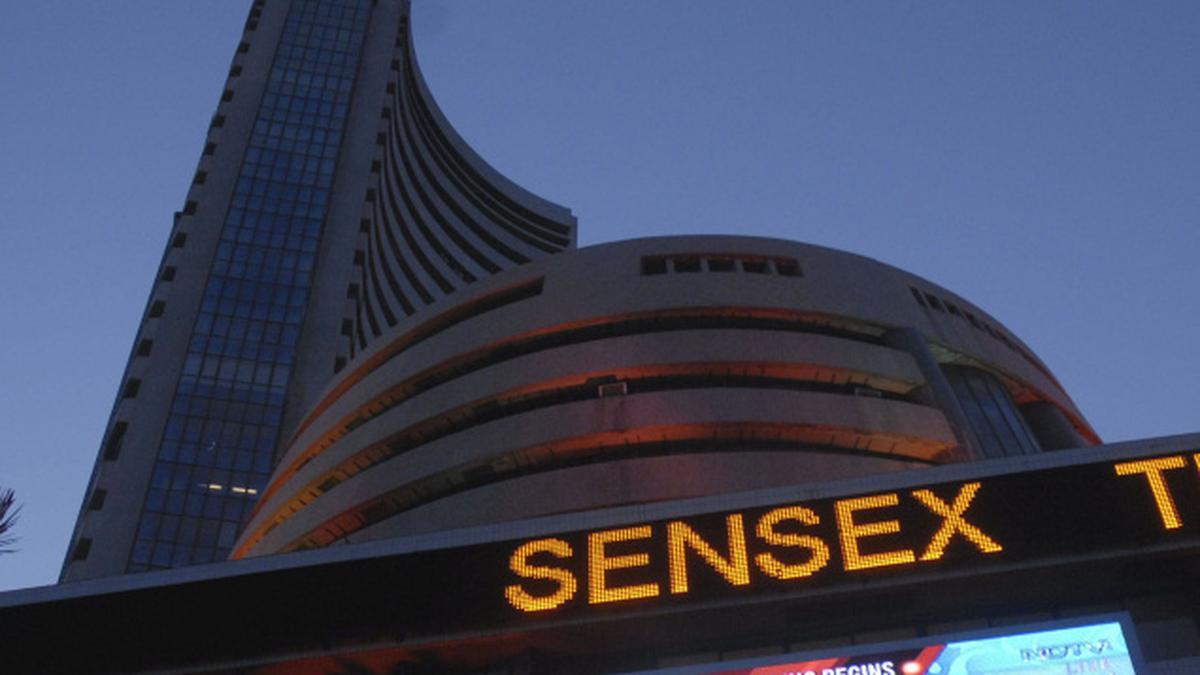

From Sensex shares, Larsen & Toubro, Tata Motors, Hindustan Unilever, Asian Paints, ITC, Power Grid, NTPC and Reliance Industries were the major laggards. File

| Photo Credit: PTI

Benchmark stock indices Sensex and Nifty closed lower on Monday (February 3, 2025) tracking weak global markets amid concerns over U.S. President Donald Trump imposing tariffs on some of its trading partners.

The 30-share BSE Sensex declined 319.22 points or 0.41% to settle at 77,186.74, snapping its five-day rally. Intra-day, it tumbled 749.87 points or 0.96% to 76,756.09. The NSE Nifty declined 121.10 points or 0.52% to 23,361.05.

From Sensex shares, Larsen & Toubro, Tata Motors, Hindustan Unilever, Asian Paints, ITC, Power Grid, NTPC and Reliance Industries were the major laggards.

Among the gainers, Bajaj Finance jumped over 5%. Mahindra & Mahindra, Bajaj Finserv, Bharti Airtel and Maruti also ended higher.

In Asian markets, Seoul, Tokyo and Hong Kong settled sharply lower.

Markets in Europe were trading with deep cuts. U.S. markets ended lower on Friday (January 31, 2025).

“Slump in global equity markets weighed negatively on Indian benchmarks after Trump announced tariffs on China, Mexico and Canada which fuelled pessimism amongst the investors. Besides, the rupee depreciating sharply raised concerns that foreign investors are unlikely to reverse the selling trend,” Prashanth Tapse, Senior VP (Research), Mehta Equities Limited, said.

The 25% tariff on most imports from Canada and Mexico and 10% tariff on goods from China will take effect from Tuesday (February 4, 2025).

“The global market got unsettled amid the onset of the ‘Trade War,’ as tariff conflicts between the U.S. and other nations are unlikely to yield any economic benefits. Instead, it may cause challenges to the global economy, heightening global financial risks,” Vinod Nair, Head of Research, Geojit Financial Services, said.

Global oil benchmark Brent crude jumped 1.15% to $76.50 a barrel.

In a day market with heavy volatility, the 30-share BSE benchmark eked out a marginal gain of 5.39 points or 0.01% to settle at 77,505.96 on Saturday (February 1, 2025). The Nifty dipped 26.25 points or 0.11% to settle at 23,482.15. The domestic equity markets were open on Saturday (February 1, 2025) due to the presentation of the Union Budget.

Foreign Institutional Investors (FIIs) offloaded equities worth ₹1,327.09 crore on Saturday (February 1, 2025), according to exchange data.

Published – February 03, 2025 05:02 pm IST